Investing in real estate is often seen as a secure way to build wealth, but purchasing an investment property for sale in Florida is not without its risks. Whether you’re a first-time investor or a seasoned property owner, understanding these risks and how to mitigate them is essential for making sound investment decisions. This guide will explore the most common risks associated with buying investment properties and offer strategies on how to avoid them.

Market Fluctuations and Economic Downturns

One of the most significant risks in real estate investment is the potential for market fluctuations. The Florida real estate market, in particular, is known for its cyclical nature. While property values can appreciate over time, they can also decline due to various factors like economic downturns, changes in interest rates, or shifts in demand.

How to Avoid This Risk?

To minimize the risk of market fluctuations, it’s important to:

- Research Local Market Trends: Understand the broader economic factors affecting the Florida real estate market, including population growth, job trends, and local government policies. Cities like Miami, Orlando, and Tampa often have strong real estate markets, but even within these regions, neighborhood conditions can vary widely.

- Consider Long-Term Investment: Real estate is generally a long-term investment, and holding on to property for several years can help smooth out the impact of short-term market downturns. Patience can pay off in the long run.

- Diversify Your Investments: Don’t put all your money into one property or location. Diversification across multiple properties or even different types of real estate (commercial vs. residential) can spread risk.

Property Management Issues

Managing an investment property can be time-consuming, especially if you own multiple units. From dealing with tenants and maintenance issues to ensuring your property remains profitable, poor property management can lead to costly mistakes and missed opportunities. Even the best investment property for sale in Florida can turn into a financial burden without effective management.

How to Avoid This Risk?

To ensure smooth property management, you should:

- Hire a Professional Property Manager: If you’re not experienced in managing rental properties, it may be worth hiring a property management company to handle the day-to-day operations. A reliable manager will take care of tenant screening, rent collection, property maintenance, and legal issues.

- Screen Tenants Carefully: Conduct thorough background checks on potential tenants to minimize the risk of late payments, property damage, or legal problems. Good tenants can significantly reduce your risk.

- Stay on Top of Maintenance: Regular property maintenance can prevent costly repairs down the line. Ensure that your investment property is well-maintained and that any minor issues are addressed before they become bigger problems.

Legal and Regulatory Risks

Florida has specific laws and regulations surrounding real estate transactions, tenant rights, zoning laws, and taxes. Navigating these legal frameworks can be tricky, especially if you’re not familiar with Florida’s property laws. Failing to comply with local regulations or overlooking important legal requirements can result in fines, legal action, or losing your investment.

How to Avoid This Risk?

To mitigate legal and regulatory risks:

- Consult a Real Estate Attorney: Working with a lawyer who specializes in Florida real estate can ensure that you follow the correct procedures during your investment property purchase. They can also help you understand the intricacies of rental laws, tax obligations, and lease agreements.

- Know Local Zoning Laws: Florida has specific zoning laws that govern what types of properties can be built or rented out in different areas. Make sure that the investment property for sale in Florida you are interested in complies with zoning regulations and can be used as intended.

- Stay Updated on Tax Regulations: Florida’s tax laws can affect your rental income and overall return on investment. It’s essential to understand property taxes, sales taxes, and other financial obligations that may arise.

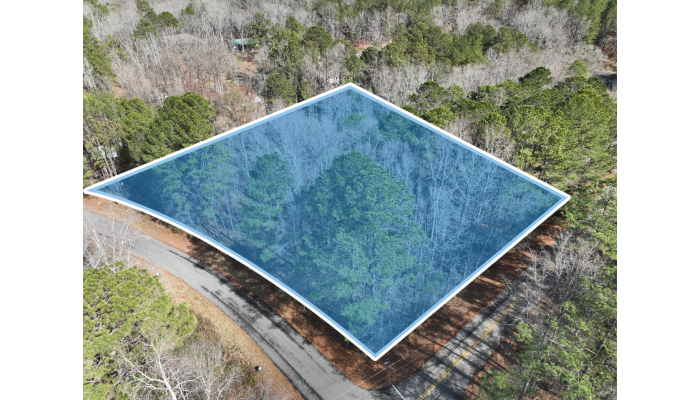

Property Location Risks

The location of your investment property for sale in Florida is crucial. Properties in prime locations tend to appreciate faster and offer higher rental income potential. However, not all areas in Florida are equally lucrative, and some may be subject to higher levels of crime, natural disasters, or economic instability.

How to Avoid This Risk?

To make an informed decision about property location:

- Conduct Thorough Research: Analyze the local economy, crime rates, school quality, and other factors that can affect property values and rental demand. Areas with growing job markets and population density tend to offer more reliable returns.

- Consider Natural Disaster Risks: Florida is prone to hurricanes, floods, and other natural disasters. Make sure to assess the environmental risks in the area and invest in appropriate insurance policies to protect your property.

- Visit the Property: Before committing to a property, visit the location in person to get a feel for the neighborhood. This will help you understand local amenities, traffic conditions, and any issues that may affect its attractiveness to future tenants or buyers.

Financing Risks

Financing an investment property in Florida can be tricky, especially for new investors. Depending on the type of loan and the terms offered, you may face high interest rates, down payment requirements, or difficulty securing financing due to market conditions or your personal financial situation.

How to Avoid This Risk?

To reduce financing risks:

- Get Pre-Approved for Financing: Before you start shopping for investment property for sale in Florida, get pre-approved for a loan. This will give you a clear understanding of how much you can afford and allow you to act quickly when you find the right property.

- Work with a Mortgage Broker: A mortgage broker can help you explore different financing options and find the best loan terms for your investment needs.

- Consider the Return on Investment (ROI): Make sure the property’s projected rental income or resale value can cover your mortgage payments and other expenses. A positive cash flow is essential to ensure the property remains profitable.

Hidden Costs and Unexpected Expenses

When purchasing an investment property for sale in Florida, many investors overlook hidden costs, such as property repairs, maintenance fees, insurance, taxes, and property management fees. These expenses can quickly add up, eating into your potential profits.

How to Avoid This Risk?

To manage unexpected costs:

- Budget for Additional Expenses: Set aside a contingency fund to cover unforeseen expenses like property repairs or vacancies. A good rule of thumb is to budget 10-15% of your annual rental income for these costs.

- Get a Professional Inspection: Before purchasing a property, have it inspected by a qualified professional to identify any underlying issues that may require repairs or upgrades.

- Factor in Property Taxes: Florida’s property taxes vary depending on the location, so research local tax rates and include them in your financial calculations.

Conclusion

Investing in investment property for sale in Florida can be highly profitable, but it comes with inherent risks. By carefully evaluating market conditions, location, and financing options, and managing your property effectively, you can reduce these risks and make informed decisions. The key to successful real estate investment lies in thorough research, proactive planning, and staying prepared for potential challenges.

Resource URL:

https://www.signaturelots.com/florida-land-for-sale/

https://en.wikipedia.org/wiki/Real_estate_investing

Fran Bullock, a literary explorer rooted in the charm of England, unearths stories that resonate with the echoes of history. With a quill dipped in nostalgia, she pens tales that bridge the past and present, weaving narratives that captivate the soul.